It should be noted that Angola has not yet signed the OECD Multilateral Instrument ("MLI") aimed at combating base erosion and profit shifting (BEPS).

The complete list of Mauritius' double taxation agreements can be found here: https://www.edbmauritius.org/info-centre/dtaa

For more information, please contact your local office office@rosemont.mu

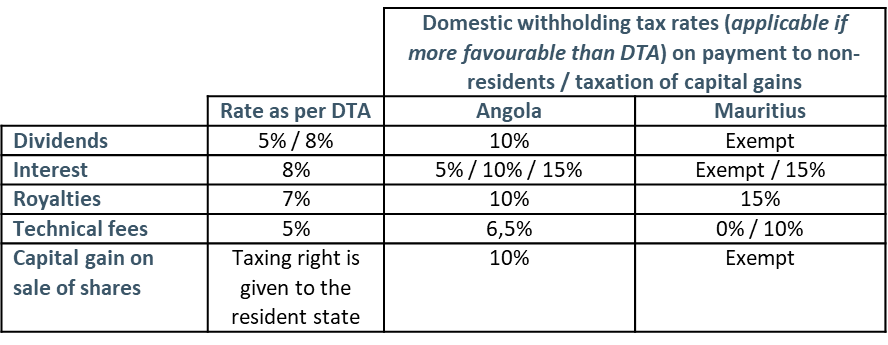

Key figures - Information from KPMG